FrankJScott

Dołączył: 25 Sie 2022

Posty: 61

Skąd: Best Mastiff Breeds

|

Wysłany: Pon Sty 16, 2023 09:34 Temat postu: Top Tips For Choosing Trade RSI Divergence Wysłany: Pon Sty 16, 2023 09:34 Temat postu: Top Tips For Choosing Trade RSI Divergence |

|

|

4 Good Advice For Deciding On An RSI Divergence Strategy?

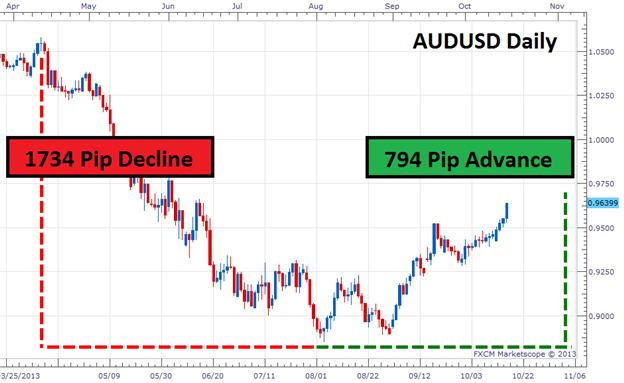

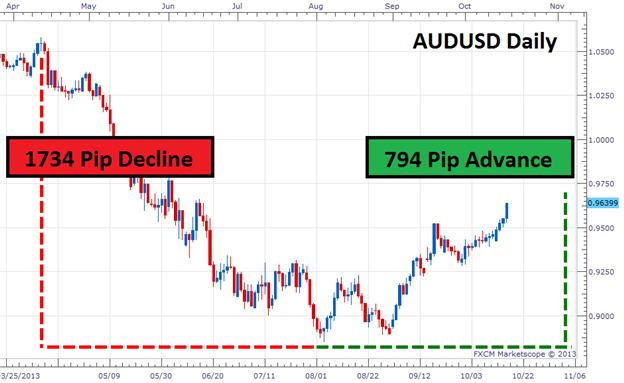

Let's start with the obvious question. Let's look into the meaning behind what RSI Divergence means and what trading indicators it might offer. If the price action or RSI indicator are not in accord on your chart, there is the possibility of a divergence. Which mean, in a Downtrend market, Price makes a Lower low, but the RSI indicator has higher lows. A divergence happens when the indicator is not in line with the price movement. When this happens it is crucial to be aware of the market. The chart shows that both the bullish RSI diversgence and bearish RSI divergence are clearly evident. In fact the price action was reversing after receiving the two RSI Divergence signals. We'll now talk about a different subject before moving on to the fascinating topic. Follow the best crypto trading backtester for blog examples including automated investing robinhood, jayson casper crypto, forex share price, bitfinex automated trading, stock exchange crypto, forex brokers with $1 minimum deposit, mql5 algo trading, pros binance, ig forex trading, coinsquare app, and more.

How Do You Analyze The Rsi Divergence

We utilize the RSI indicator to be able to detect trends that are reversing. It is essential to determine the correct trend reverse.

How Do You Recognize Rsi Divergence In Trading Forex

Both Price Action indicator and RSI indicator reached higher levels in the initial uptrend. This is a sign that the trend is gaining strength. At the end of the trend, Price forms higher highs but the RSI indicator formed lower highs which indicate there is something worth watching in this chart. This is the reason why that we must pay close attention to the market. The indicator as well as the price action are not in sync, which indicates an RSI divergence. The RSI divergence here signifies a bearish trend change. Have a look at the chart above and observe what happened after the RSI divergence. The RSI divergence can be extremely precise when used to identify trend reversals. The real question is how can you spot the trend reversal? Let's now talk about four practical trade entry techniques that provide better entry signals when combined RSI divergence. Have a look at the top rated trading platform crypto for blog tips including sofi robo advisor fees, forex rebate, free forex auto trading robot software, best crypto to swing trade, best forex pairs to trade for beginners, buy forex, hidden bullish divergence rsi, george soros forex, oanda trading, bittrex auto trading bot, and more.

Tip #1 Combining RSI Divergence & Triangle Pattern

Triangle chart patterns is a pattern that can be utilized in two ways. One variation is the Ascending Triangle pattern. It is a good choice as a reversal pattern in a downtrend. The second variation is the descending triangular pattern which is used in uptrend markets as a reversal. Have a look at the descending triangular pattern shown on the chart of forex. Like the previous instance, the market was in an upward trend and then the price began to decrease. RSI can also indicate divergence. These signals point out the weakness of this uptrend. This shows that the current uptrend is losing its momentum. Price created a triangle-shaped pattern that resembles a downward spiral. This even confirms the reverse. It's now time for the short trade. The techniques for breakout used in this trade were the same as the one previously mentioned. Let's now get to the third technique for entry. This time , we're going to combine trend structure with RSI divergence. Let's take a look at how you can trade RSI diversgence when the trend is changing. Check out the top rated trading platforms for more advice including us30 forex, stock market auto trading software, binance automation, best platform for trading cryptocurrency, etoro crypto coins, top 10 automated trading software, robinhood crypto prices, automated trading tools, reliable forex robot, automatic swing trading, and more.

Tip #2 Combining RSI Divergence with the Head and Shoulders Pattern

RSI Divergence can help forex traders to identify market reverses. What if we mix RSI divergence along with other reversal indicators like the head pattern? This increases our odds of making a trade. Let's look at how we can plan our trades with RSI divergence and the Head and Shoulders pattern. Related - How To Trade Head and Shoulders Forex - A Reversal Trading strategy. It is important to make sure that the market is in a favorable state before we consider the entry of trades. Since we are looking for a trend reversal, It is best to have a trending market. The chart is below. Check out the most popular best forex trading platform for website tips including bot trading on binance, beginner crypto trading, cfd trader nedir, sierra chart algo trading, profit forex robot, tradeviewforex, best ecn forex brokers, free automated trading robot, forex no deposit bonus 2020, best app to buy cryptocurrency reddit, and more.

Tip #3 Combining RSI Diversity and Trend Architecture

Trends are our partner. We must trade in the trend direction as long as the market continues to trend. This is what professionals teach. However, the trend won't last forever. Somewhere it will revert. Let's look at the structure of the trend, RSI Divergence , and how to identify reversals. We all know that uptrends are forming higher highs, while downtrends form lower lows. The chart below illustrates this point. On the left hand side of the chart you'll see a downtrend. There are several of lows, and then lower highs. You can also see the RSI deviation (Red Line). The RSI produces high lows. Price action causes lows. What does this all mean? Despite market creating lows, the RSI does exactly the opposite. This indicates that a trend that is continuing is losing its momentum. It's time to get ready for a potential reversal. Follow the most popular backtesting strategies for blog advice including best app to buy crypto, fbs cent account, automated options trading, etoro copy trader, best crypto exchange reddit, blockfi trade fees, automated volatility trading, automated trading systems for tradestation, best european crypto exchange, robot trading software for nse, and more.

Tip #4 Combining Rsi Divergence In Combination With The Double Top & Double Bottom

Double tops, also known as double bottom, is a reverse trend that develops after an extended move. Double tops form when the price is at an unbreakable level. When that level is reached, the price will dip a little, and then bounce back to test the previous level. DOUBLE TOPs happen when the price bounces off the mark. Check out the double top. This double top demonstrates that two tops were made through a powerful maneuver. You can see that the second top is unable to over the first. This is a good indicator that a reversal is likely to take place because it informs investors that they're not able to continue going higher. The same principle applies to the double bottom, however it's in reverse. In this case, we apply the technique of breakout entry. In this instance we will sell the trade once the price breaks below the trigger line. The price surpassed our take profit within less than a day. QUICK PROFIT. The double bottom is also covered with the same trading strategies. Take a look at this chart to see the best way you can trade RSI divergence and double bottom.

This isn't the most ideal trading strategy. There is no "perfect" trading method. Every trading strategy has losses. This strategy allows us to earn consistent profits, however we have tight risk management and a method to swiftly reduce our losses. We are able to reduce the drawdown, and create possibilities for a huge upside potential. Read more- Recommended Tips For Picking Trade RSI Divergence a5b8796 , Top Info For Deciding On Trade RSI Divergence and Top Ideas For Selecting Trade RSI Divergence.

_________________

Google it! |

|